Jackson Associates Provides Consulting Services to Assist Financial Firms Develop Accurate Financed Scope 3 Emissions

Data Development and Reporting Strategies

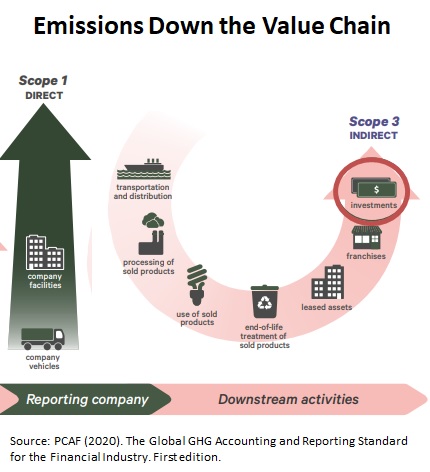

Click Here to See Three Notes Describing Challenges Related to Calculating Annualand Year-to-Year Scope 3 Emissions Report Data Summary. Financial institutions are facing increasing pressure to report Scope 3 financed emissions. In addition to voluntary reporting,the state of California passed two bills in October 2023 that require Scope 3 emissions disclosures for financial firms "doing business" in the state. The "doing business in California" criterion is met if the firm has property in California exceeding $75,000, or payroll in California exceeding $75,000. CA Scope 3 emissions reporting is required in 2027 with data from 2026. With such a short time horizon, financial firms should be finalizing reporting strategies and data in 2025. These emissions can easily account for more than 95 percent of total emissions for financial and other firms. This huge new reporting requirement opens the door to independent auditing and challenging of the reported results, so affected firms need to take this new rule seriously and to conscientiously conduct required analysis and reporting to avoid challenges to corporate CSR commitments. Financial institutions outside California should also take notice as trends in California often lead to similar requirements in other states. Since these Scope 3 emissions can account for nearly all financial institution emissions, a reliable calculation of current emissions is important. More critical are the year-to-year emissions intensity estimates (e.g., emissions/mortgagor) presented for investors to evaluate emissions improvements over time. Inaccurate emissions calculations and emissions intensity statistics can sabotage a financial institution’s public image by reflecting increased emissions intensities when the opposite is true. Or, in a worst-case scenario, result in an external audit showing that reported emissions intensities are overestimating emissions improvements. Avoid working through the 150+ page PCAF accounting recommendations (Partnership for Carbon Accounting Financials - an international organization of financial institutions that provides a guide to Scope 3 calculation methodologies) to develop a strategy that provides the most accurate calculation of your financial firm's Scope 3 emissions including strategies to protect against biases emissions intensity calculations and reputational risk. See our most recent white paper on these emissions intensity calculation risks here Jackson Associates (JA) Consulting Experience. JA has consulted with more than 150 state and federal government agencies, energy utilities and private companies concerning energy use estimation and related analysis. JA has provided testimony in dozens of utility-related regulatory proceedings and has provided energy use analysis supporting energy efficiency regulations for state agencies and the US Department of Energy. See a partial list of clients here and more of my background here As the author of the widely used 7+ million record MAISY Utility Customer Energy Use Databases, JA has extensive experience in "big data analysis " and development and validation of huge data sets Financed Scope 3 emissions can be developed with a variety of strategies; however, following the PCAF recommendation of continuously improving data input can result in emissions intensity measures (e.g., CO2e/mortgagor) that show year-to-year changes that can grossly over or under estimate financed emissions improvements. Financial firms need to carefully consider and develop strategies that eliminate this risk. Contact us to discuss your reporting needs and an assessment of the most cost-effective approach to meeting those needs.

Jerry Jackson, President |