Summary Electrification is the umbrella term for transitioning to electricity in all

possible applications to reduce greenhouse gas emissions. Dozens of cities and states have

embarked on policies to limit fossil fuel use in new residential buildings and or appliances.

A recently completed study based on analysis of 18,400 US households

concludes that while residential electrification would reduce emissions, the additional burden

on already strained electric grid capacity will significantly postpone or alter many of these

initiatives.

Utilities are already facing unprecedented electricity demand growth in large part

because of the huge increase in the number of new data centers. According to Wells Fargo,

electricity demand could conceivably increase by as much as 20 percent by 2030. This unexpected

electricity demand surge is causing utilities and grid operators angst across more than a dozen

states resulting in delayed decommissioning of coal generation and the addition of gas-fired

peaking units to provide power during peak periods (e.g., 5-9 pm in the summer).

A critical question for the future of residential electrification initiatives is

how much these programs would add to electricity demand and what are the emissions savings.

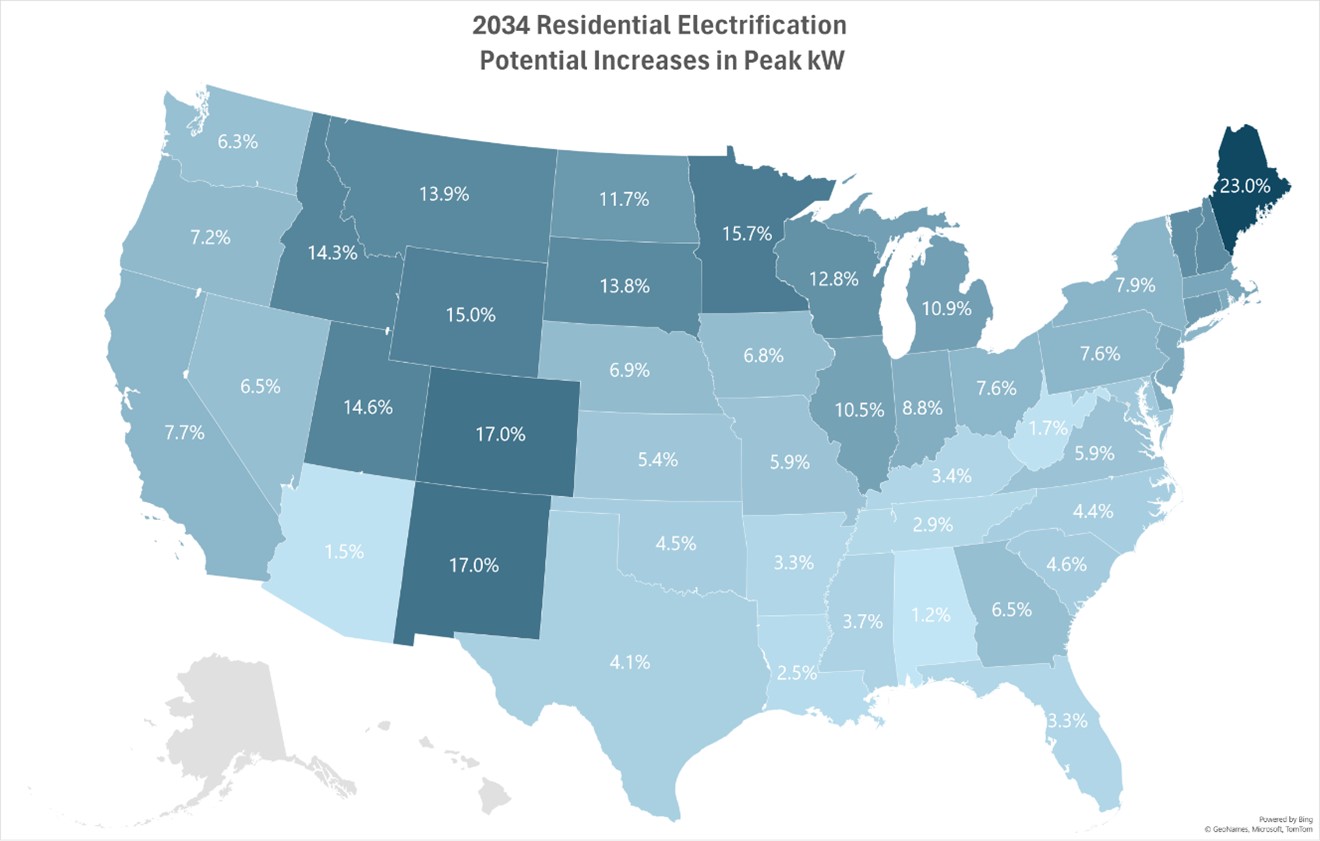

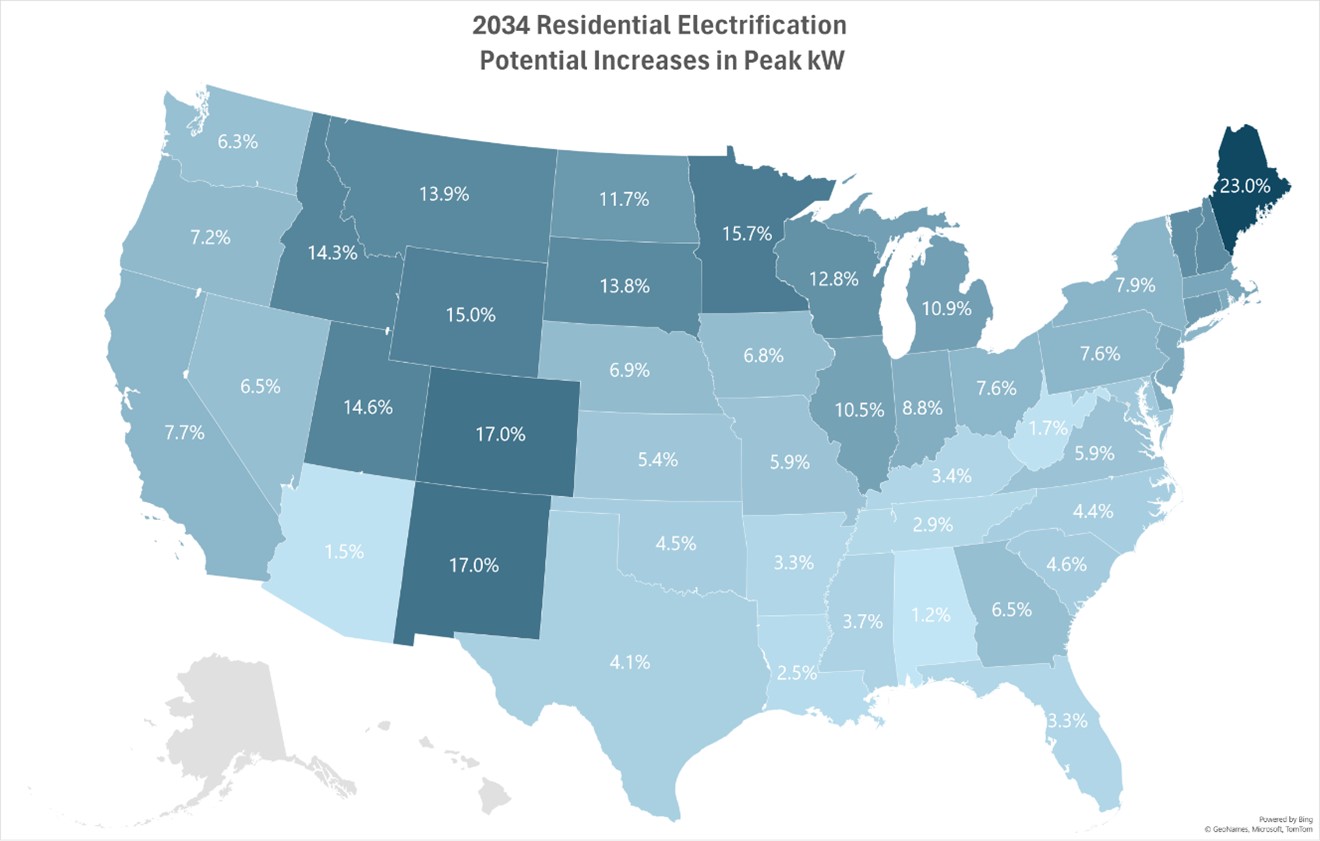

The map shows potential percentage increases in peak period kW demand based solely

on residential electrification over the next decade. These results reflect analysis of hourly

loads for 18,400 actual residential households across the US assuming that all new residential

dwelling units in the coming decade are all electric. This scenario analysis, referred to as

“technical potential,” is traditionally applied in policy analysis to evaluate costs and benefits

that would result if programs were universally adopted. From that baseline, it is easy to adjust

peak kW, emissions, and other impacts to program adoptions less than 100 percent (e.g., 50

percent adoption = 50 percent of technical potential costs and benefits).

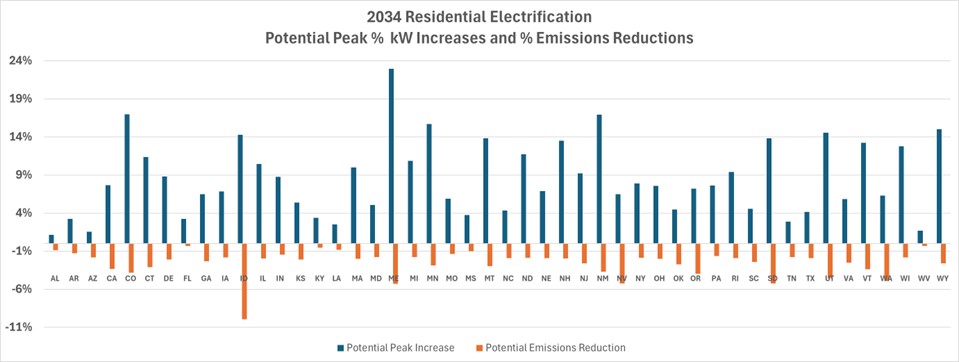

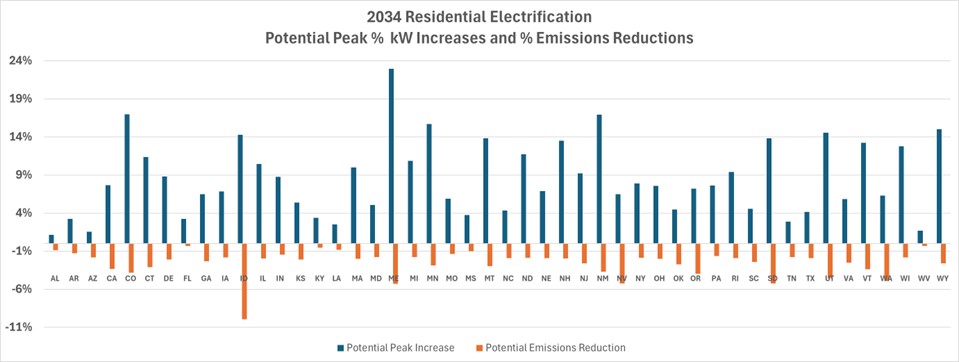

The significant increases in residential peak kW resulting from an electrification “technical

potential” scenario over the next decade provide only modest gains for most state

residential emissions as indicated by the chart below.

The relatively large residential uptick in electricity use in peak afternoon

and evening periods and the small savings in greenhouse gases suggests that additional

burdens associated with electrification will be a hard sell to consumers as the current

trajectory of electricity demand is already significantly increasing residential

electricity prices.

Consequently, residential electrification will likely need to wait until

the electric grid digests the huge meal provided by new data centers and manufacturing

growth before proceeding on its mission to reduce greenhouse gases.

The remainder of this paper includes a summary of the study design,

statistics on each of the 48 continental states including forecast peak kW increases,

GHG reductions, dwelling unit increases from 2024 to 2034, and commentary on selected

states and other data.

Study Design

Baseline 2024 greenhouse gas (GHG) emissions, annual electricity use (MWH) and peak MW were developed for each state by updating 2020 survey data from the US Department of Energy RECS survey that was recently extended to include emissions data and 8760 hourly loads for each of 18,400 households across the US. An historical ten-year growth rate for each state was used based on recently constructed dwelling unit characteristics to forecast (1) an increase in household energy use and peak period demand through 2034 without any electrification programs and (2) energy use and peak period demand in 2034 that would result if all new residential construction adhered to a strict no-fossil fuel requirement. This hypothetical “technical potential” program evaluation provides information on electrification potential to guide decision-maker judgment on the maximum potential impacts of residential electrification programs and impacts of programs for less than full adoption.

Why Residential Increases in Peak Demand are Critical Issues for Grid Capacity

The US residential sector reflects approximately 39 percent of total US electricity use; however, its contribution to electricity demand in summer 5-9 pm peak period within electricity supply areas can range from 45 to 65 percent.

This oversized impact on peak demand is a result of the decline in hourly commercial and industrial loads prior to this critical time period and the increase in residential electricity use as households prepare meals and undertake a variety of household tasks.

Consequently, the impact of residential electrification on peak demand is a huge consideration as state policy makers, regulators, and utilities address current challenges serving new demand from data centers and manufacturers.

Summary Analysis Results

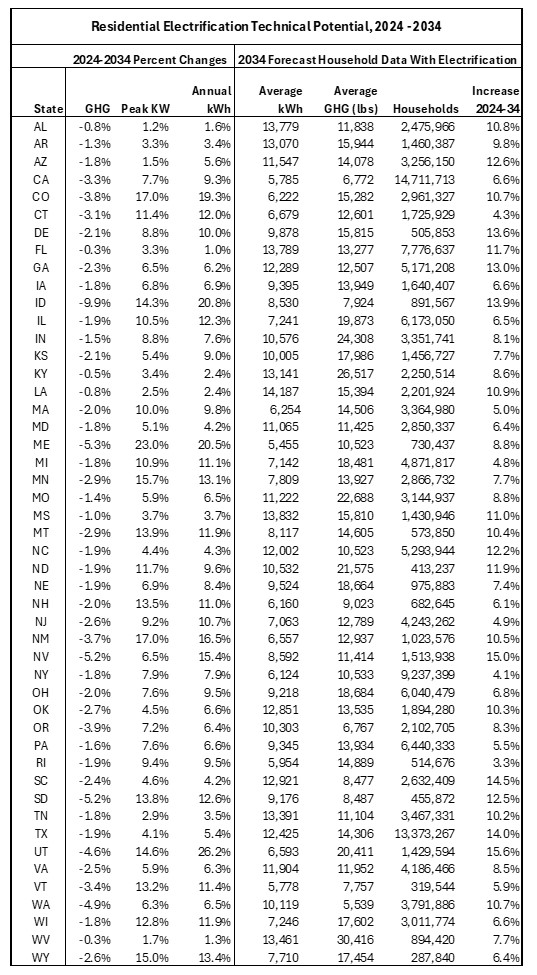

Actual household data were used to develop GHG, KWH, and peak summer kW for households in each state in 2034 without and with electrification protocols to identify the potential kW peak, and kWh energy burdens along with emissions reductions.

Analysis results reveal that the electrification GHG reductions are highly correlated with peak kW demand increases – that is, states that stand to gain the most GHG reductions also face the largest grid capacity challenges and the greatest need to add natural gas generation to meet new peak (MW) and energy (MWH) needs.

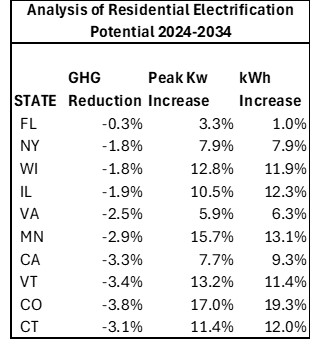

Results of the electrification analysis are shown for ten representative states along with state-specific comments. Results for all 48 continental states, including additional state-level data including dwelling unit growth rates for 2024-2034 are provided in the following section without comments.

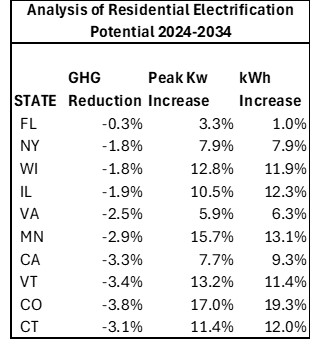

Florida: Florida reflects a small potential for reducing GHG, peak kW and kWh because the state’s residential households already have an overwhelming percentage of electric water heating, space heating, clothes drying, and cooking compared to fossil fuels. Many other states in the southeast reflect similar statistics.

Virginia: Virginia is included in this summary because it is experiencing a critical kW demand shortage because of a huge increase in server farms in northern Virginia. With a small 2.5 percent saving in residential GHG, the 5.9 percent increase in residential peak kW and 6.3 percent increase in electric generation would add a significant burden to an already stressed grid.

Wisconsin: Coal plant closures are being delayed in WI so the small 1.8 percent savings in residential GHG coupled with a 12.8 percent increase in residential peak kW and a 11.9 percent increase in energy productions is not likely to be viewed as a feasible option.

New York and California: These two states are the most active in promoting residential electrification. NY’s GHG 1.8 percent savings is a small benefit for the 7.9 percent increase in peak demand capability. California’s 3.3 percent residential electrification GHG savings is a poor trade-off for an increase in peak demand kW of 7.7 percent for an electric system that continues to be plagued with summer brownouts.

Illinois, Minnesota, Vermont, Colorado, Connecticut: These five states, likely to be more accepting of electrification policies reveal significant challenges involved in meeting new electric appliance requirements with peak kW demand increases from 10.5 to 17 percent over the ten-year period yielding only an average of 3 percent residential GHG reduction.

Conclusions

Residential electrification holds out the promise of reducing greenhouse gas emissions by switching fossil fuel appliances to electricity. However, shifting traditional natural gas, propane, and oil fired appliances to electricity also increases electricity demand in the critical summer peak period 5-9pm hours. Since late afternoon-evening provides no solar offset, this increased peak period demand also requires fossil fuel generation. At some point in the future battery storage and virtual power plants drawing off EVs can reduce this strain on the grid; however, that time is at least decades in the future.

In the meantime, unexpected huge increases in data centers and manufacturing activity could, according to Wells Fargo, increase electricity demand by as much as 20 percent by 2030. This likely electricity demand surge is causing utilities and grid operators serious concerns about meeting peak demand (e.g., 5-9 pm in the summer) and electricity use in other time periods. These alarms are resulting in delayed decommissioning of coal generation and the addition of gas-fired peaking units.

Large residential electrification increases in electricity use in peak afternoon and evening periods and typically small savings in greenhouse gas emissions suggests that additional burdens associated with electrification will be a hard sell to consumers and regulators as the current trajectory of electricity demand is already increasing residential electricity prices.

Consequently, residential electrification may need to wait until the electric grid digests the huge meal provided by data centers and manufacturing before proceeding to its mission to reduce greenhouse gases.

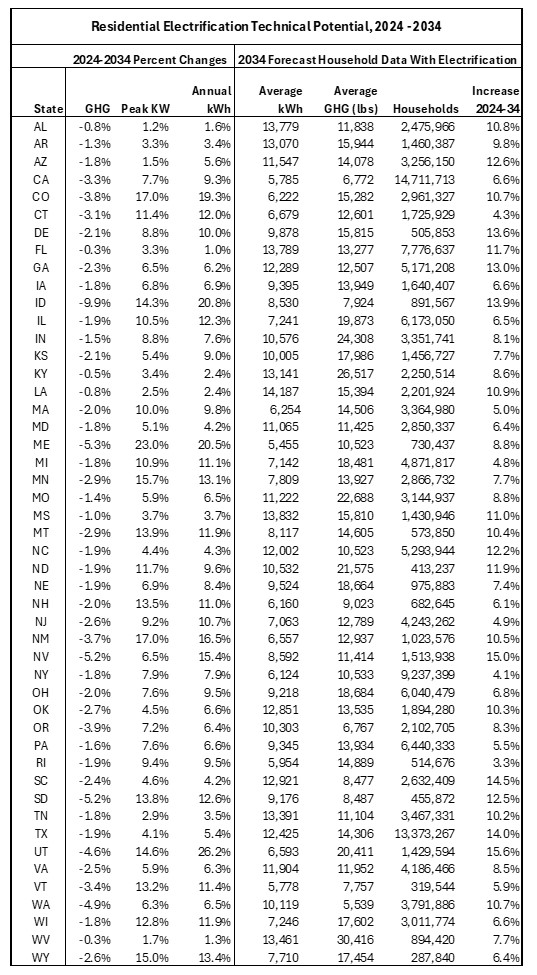

Additional Study Detail

The following table provides detailed results for each of the 48 continental US states. Questions concerning these data can be addressed to the author at jjackson@maisy.com .

About Jackson Associates

Jackson Associates (JA) publishes MAISY Residential and Commercial Energy Use

and Hourly Loads Databases, MAISY RECS Databases and MAISY Scope 3 Emissions

Databases. JA also provides smart grid and load management analysis including

market sizing, market potential, and target marketing. Clients include technology

developers, equipment manufacturers, retail electric providers,

electric utilities, state and federal government agencies and other

energy-related companies.

|