MAISY Financed Emssions Scope 3 Data Reporting Risks

New York Attorney General’s Emissions Lawsuit Highlights Scope 3 Reporting Risks

|

Summary. The recent lawsuit by the NY Attorney General against JBS foods (the largest beef processor in the US) challenging their emissions reporting highlights the reputational and financial risks associated with questionable emissions reporting.

This paper provides an update to a previous paper (Mortgagor & CRE Emissions Calculations: A 3-Page Summary, June 2023, https://maisy.com/scope3_financed_calc_summary.htm ) that identifies Scope 3 financed emissions reporting risks associated with changes in geographic distributions of mortgagors across different EPA emissions zones over time. An index-based emissions intensity (CO2e/mortgagor) calculation, similar to indexing methodology used by the US Department of Commerce, removes the bias that would occur if changes in mortgagor geographic distributions were ignored. Analysis of 18,400+ individual household emissions across the US reported here shows that changes in 7 other mortgagor characteristics over time can generate even more significant biases in reported emissions statistics unless addressed with index-based emissions calculations. Who Will Have to Report Scope 3 Financed Emissions ? The state of California passed two laws in October 2023 that require financed Scope 3 emissions disclosures. Any financial institution with annual revenues greater than $500 million doing business in California will be required to report Scope 3 emissions. These laws will cast a wide net across companies nationwide. This huge new reporting requirement entails a variety of risks for financial institutions including independent auditing and legal challenges, reputational risks associated with deficient or inaccurate reporting, and potential financial risks associated with regulatory policies. Financial institutions should prepare to address these challenges. Financial institutions outside California should also take notice as trends in California often lead to similar requirements in other states. Emissions Reporting Protocols. The Partnership for Carbon Accounting Financials’ Global GHG Accounting & Reporting Standard (the “PCAF Standard”) describes a general methodology for calculating financed emissions and is considered a “gold standard.” (see https://maisy.com/scope3_financial_reporting.htm for a summary of PCAF emissions accounting recommendations). The PCAF Standard is vague and suggests starting with aggregate emissions intensity measures (e.g., aggregate average CO2e lbs. /mortgagor). The paper referenced above proves, with an example, that applying aggregate emissions intensities recommended by standards organizations and most consulting companies, will provide biased and unreliable estimates over time if there is a change in the distribution of mortgagors’ locations across EPA emissions zones. The objective of this current study is to identify distributions of other mortgagor characteristics that are likely to bias emissions intensity calculations unless recognized in indexed-based calculations. All financial institutions should carefully evaluate the integrity of reported Scope 3 financed emissions because residential household data like that applied in this study can be used by stakeholders in detailed, sophisticated analysis to assess and potentially challenge financial institution reported emissions data. Which Mortgagor Characteristics Cause Emissions Intensity Biases? If a financial institution’s customer characteristics remained the same over time or increased proportionately across all dimensions (geography, income, demographics, etc.), a single average CO2e/mortgagor emissions estimate could be used to estimate unbiased total emissions and an emissions intensity from one year to the next. However, evolving economic and market conditions change loan portfolio characteristics creating an emissions intensity calculations issue. For example, applying state average CO2e emissions intensity to a loan portfolio that is growing faster in Nevada (average 12k lbs CO2) than California (average 7k lbs CO2) will show an increase in the loan portfolio total emissions intensity even if new mortgage customers in both states are occupying dwelling units that are more efficient.

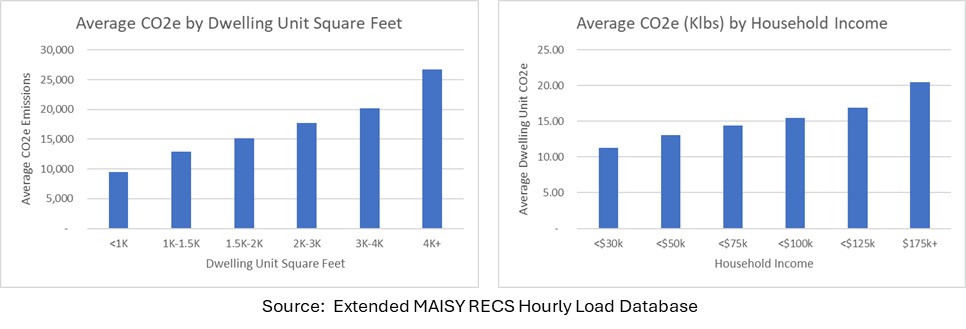

Adjusting for mortgagor location/emissions is an easy solution since a financial institution knows each mortgagor’s ZIP and state. However, all mortgagor characteristics correlated with energy use/emissions are candidates for inclusion in an index-based emissions intensity measure to eliminate aggregation bias. The two charts below based on analysis of more than 1,000 Texas households show significant variation across dwelling unit sizes and household income. Trends towards larger dwelling and greater household income will have the same upward biasing effect on aggregate (i.e., non-indexed) emissions intensities as in the CA-NV location example.

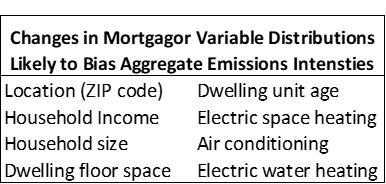

Analysis of the relationship between emissions and mortgagor characteristics in 18,400 households across the US undertaken in this paper indicates that changes in the distribution of 8 characteristics within a mortgage portfolio should be considered in calculating index-based Scope 3 financed emissions to insure unbiased emissions reporting. These data can be incorporated in index-based emissions intensity measures using actual data on individual mortgagors or using available mortgagor data along with geographic specific data (e.g., ZIP averages for mortgagor household segments). A Quick Insight on Mortgagor CO2e Diversity. The importance of variations in individual mortgagor characteristics impacting CO2e emissions within a loan portfolio can easily be explored with a free residential energy use/emissions Web analysis that provides CO2e emissions for a wide variety of household and dwelling unit characteristics across all US ZIP codes. Summary. Calculating unbiased and accurate year-to-year Scope 3 financed GHG emissions is a much greater challenge than described in government, industry and consulting firm literature. Year-to-year changes in mortgagor portfolio variable distributions result in year-to-year emissions intensity (e.g., CO2e/mortgagor) biases if not properly considered. Only an index-based emissions intensity calculation strategy that takes into account changes in mortgagor distributions of energy-related characteristics can minimize reputational and financial risks associated with inaccurate reporting. Financial institutions need to prepare to address potential audits and stakeholder challenges and associated reputational and financial risks. |

Other MAISY Financed Emissions Accounting Data and Services Topics |