Caution: Avoiding Scope 3 Financed Emissions Data Development Pitfalls

Summary: Avoiding Scope 3 Financed Emissions Data Development Pitfalls

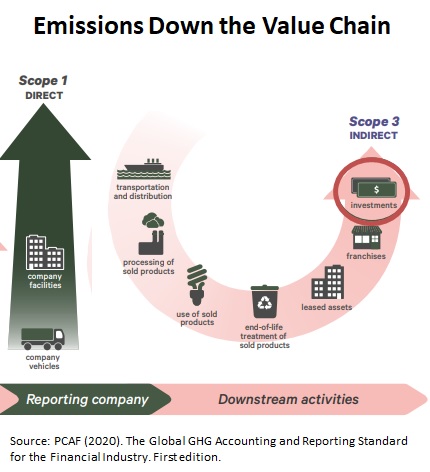

Click Here to Download the 5 Page PDF Whitepaper A proposed SEC rule will likely soon require mid-to-large publicly-traded financial institutions to calculate and report emissions of their residential mortgagors and commercial real estate (CRE) loan customers (so-called downstream or Scope 3 emissions). These proposed rules create a huge new reporting requirement and a challenging data development effort for financial firms. This white paper provides context to these data issues in the proposed rule along with issues associated with geographic detail, estimation of average dwelling unit energy use, and issues associated with emissions intensity calculations. The paper illustrates the dangers of using inappropriate data to fulfill these new reporting tasks. More specifically, examples show how using aggregate geographic and customer population energy use data (e.g., national, regional or state averages) biases estimates and can easily either overstate or understate emissions and changes in emissions intensity estimates over time. Since emissions intensity is promoted as a metric to determine increasing or decreasing emissions efficiency and risks over time, these errors carry the potential for reputational risk as increasing focus is placed on individual company calculations of these reporting requirements. The paper addresses emissions intensity calculation challenges and offers a new price-index based methodology drawn from economic theory that adjusts for changes in customer geographic and household characteristics to minimize biases in reported emissions statistics. This methodology is used by the US Department of Commerce in price index calculations and is a well-accepted approach to account for the kind of computational complexity inherent in the emissions intensity statistic. Brief Takeaways The SEC identifies the Partnership for Carbon Accounting Financials’ Global GHG Accounting & Reporting Standard (the “PCAF Standard”) as an acceptable reporting standard. More than 30 US financial institutions have already committed to applying this standard. The standard methodology for residential mortgagors, in the most basic form, calculates emissions as follows: Emissions = average dwelling unit energy use * # mortgages * emission factor * attribution factor eq(1) Emissions Intensity = emissions /activity level eq(2) Attribution factor is the ratio of outstanding loan amounts to the property values at loan origination. Emission factors are available from the EPA while number of mortgages and the attribution factor are available from the financial institution’s records. The data development challenge is:

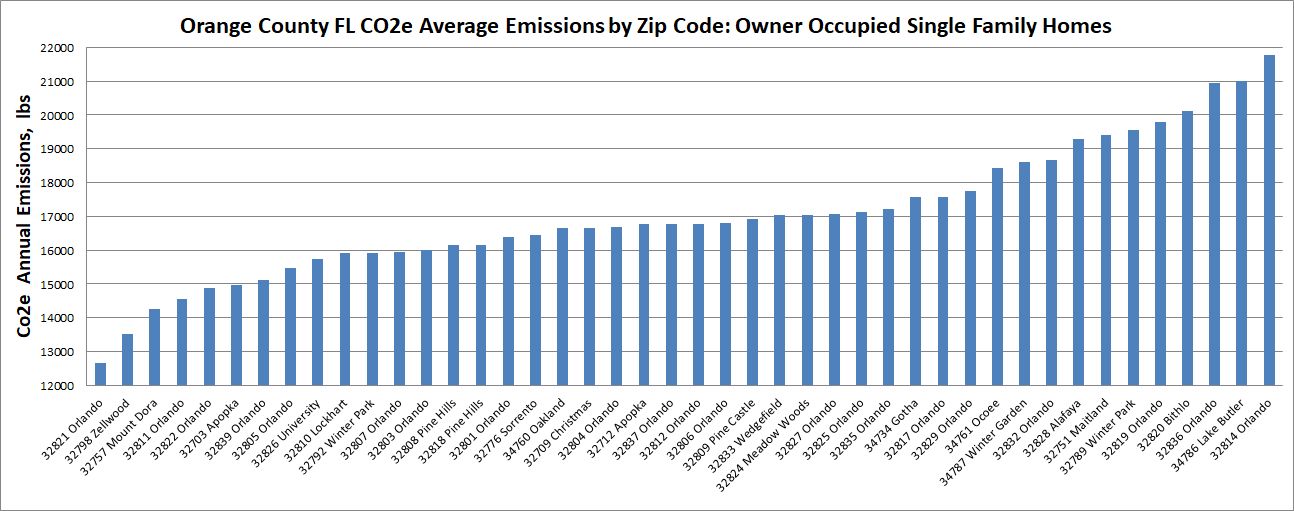

The importance of recognizing average energy use and emissions variations across individual ZIP code areas is illustrated with data for ZIP codes in Orange County Florida (population ~ 1.2 million) in this chart (Source: MAISY Scope 3 Mortgage Emissions Database).

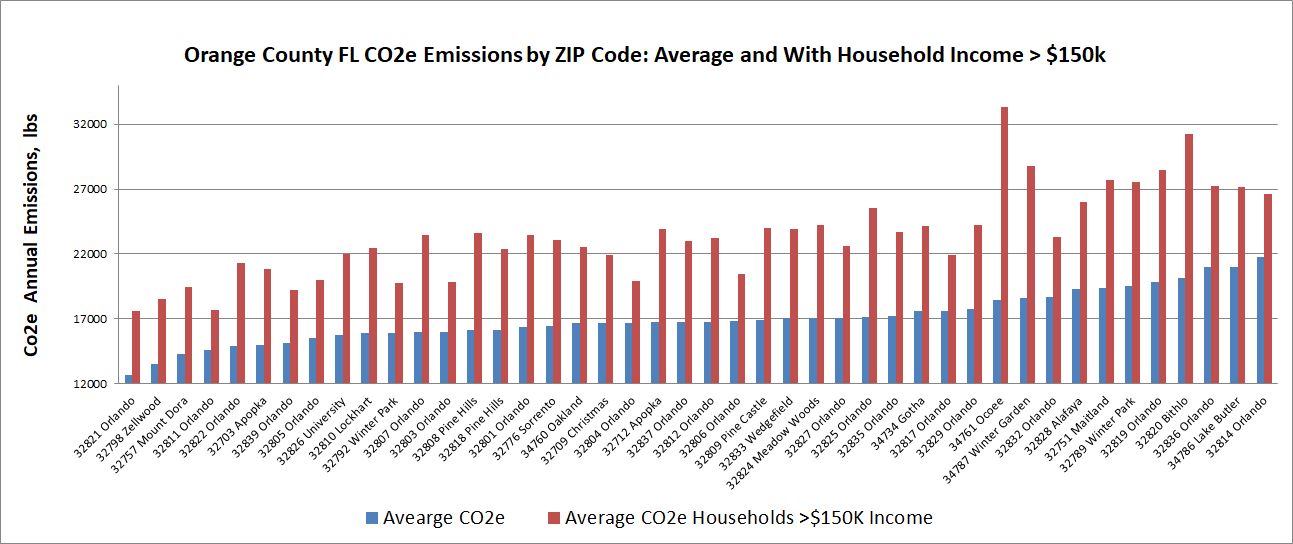

Mortgagor Scope 3 emissions accuracy can be improved by identifying ZIP level mortgage customers by customer segments defined by annual income as indicated in the following chart (Source: MAISY Scope 3 Mortgage Emissions Database).

Finally the paper addresses emissions and emissions intensity calculation challenges and reputational risk associated with biased emissions intensity statistics that arise when using overly aggregated geographic and customer population data. The paper offers a new price-index based methodology drawn from economic theory that adjusts for changes in customer geographic and household characteristics to minimize biases in reported emissions statistics. This methodology is used by the US Department of Commerce in price index calculations and is a well-accepted approach to account for the kind of computational complexity inherent in the emissions intensity statistic. Jerry Jackson, President of Jackson Associates (JA), is the author of MAISY ZIP Level Scope 3 Emissions Databases, developed from MAISY ZIP Level Utility Customer Energy Use Databases. MAISY Databases were first introduced in 1995. Annual updates have expanded databases to include data from more than 7 million US utility customer records. MAISY data have been used by the US Department of Energy in analysis supporting appliance efficiency standards, by state regulatory agencies from Texas to New York, and by dozens of solar and other energy equipment manufacturers and utilities and retail electricity providers. He has provided testimony in a variety of state and provincial hearings as an expert witness on data development and forecasting issues. He published “Energy Budgets at Risk (EBAR): Risk Management Approach to Energy Purchase and Efficiency (Wiley, April, 2008),” the first extension of risk management principles to evaluate building energy efficiency investments. He received a patent in 1995 for a drill-down and data visualization technology that has been licensed by Microsoft, Oracle, SAP and every other major business intelligence software provider. He holds a Ph.D. in economics from the University of Florida. Previous positions include signature professor at Texas A&M University, Chief, Applied Research Divisions at Georgia Tech Research Institute and economist at Oak Ridge National Laboratory and the Federal Reserve Bank of Chicago. Click Here to Download the 5 Page PDF Whitepaper |

Other MAISY Financed Emissions Accounting Data and Services Topics |